Choose your Trading Strategy (I)

2022-05-09Anticipation Strategy

Anticipation Strategy refers to the traders forecast the final breakout direction of the market, early placement of positions, rather than wait until the obvious breakout signal. There is possible to cause a certain loss risk due to the failure of the direction forecast. However, as long as risk control is done well, it is probably getting a greater return than the Breakout Strategy.

How to use Anticipation Strategy ?

Take long-term trend traders for example, they rarely trade in shock trend except uptrend and downtrend. They usually use analysis indicators&charts in the end of the shocking markets to forecast the direction before the price breakout.

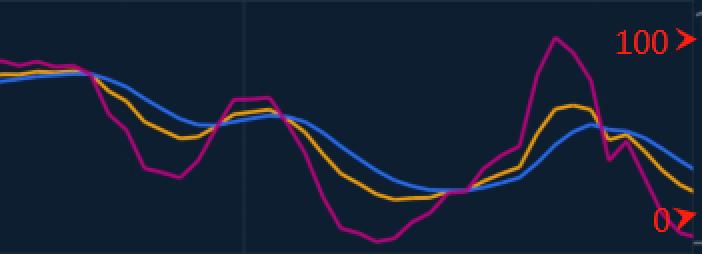

As the chart shows, the channel shrinks and the price fluctuates in a small range, if we forecast the final direction goes up, make a long position on the lower rail and a stop loss on the resent low point.

If the price breakout uptrend, we gain a big reward potential.

on the contrary, if the price breakout downtrend, we stop loss and close out.

However, We can accept the loss risk because of the well done risk management.

English

English

TIẾNG VIỆT

TIẾNG VIỆT

简体中文

简体中文

Malay

Malay

Español

Español

Deutsch

Deutsch

Italiano

Italiano

Français

Français

Indonesia

Indonesia