A History of Forex

2022-05-09The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling, and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

The beginning of forex

Since the time of the Egyptian pharaohs, the types of currency have been constantly changing from one type to another. Although the Babylonians were recorded as the first people in history to use paper as bills, the currency dealers in the Middle East were the first merchants in the world to conduct currency transactions. They exchanged a country's coins for coins of another country.

In the Middle Ages, the demand for other forms of money other than coins began to appear, because the selection method was updated continuously. These paper-made receipts were used as a convertible third-party fund payment form at that time so that merchants and foreign trade merchants at that time could simply exchange foreign exchange and prospered the local economy.

During the 15th century, the Medici family were required to open banks at foreign locations to exchange currencies for acting on behalf of textile merchants.

To facilitate trade, the bank created the Nostro (from Italian, this translates to "ours") account book,

which contained two columned entries showing amounts of foreign and local currencies;

information of the keeping of an account with an international bank. During the 7th (or 18th) century,

Amsterdam maintained an active Forex market. In 1704, foreign exchange took place between agents

acting in the interests of the Kingdom of England and the County of Holland.

The development of modern foreign exchange

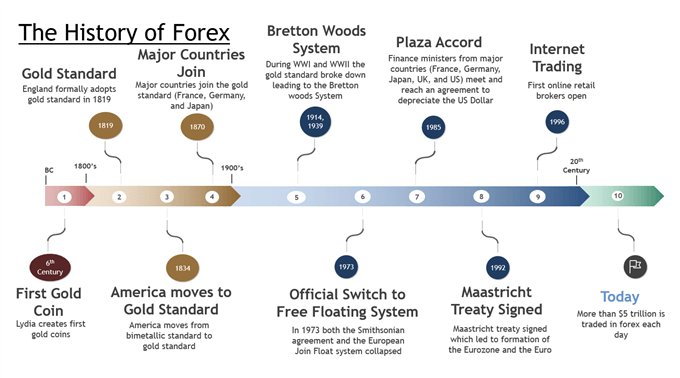

Key events which have shaped the forex market

Alex. Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA.

In 1880, J.M. do Espírito Santo de Silva (Banco Espírito Santo) applied for and was permitted to engage in a foreign exchange trading business.

The year 1880 is considered by at least one source to be the beginning of modern foreign exchange: the gold standard began in that year.

From 1899 to 1913, holdings of countries' foreign exchange increased at an annual rate of 10.8%, while holdings of gold increased at an annual rate of 6.3% between 1903 and 1913.

At the end of 1913, nearly half of the world's foreign exchange was conducted using the pound sterling. The number of foreign banks operating within the boundaries of London increased from 3 in 1860, to 71 in 1913. In 1902, there were just two London foreign exchange brokers. At the start of the 20th century, trades in currencies were most active in Paris, New York City, and Berlin; Britain remained largely uninvolved until 1914. Between 1919 and 1922, the number of foreign exchange brokers in London increased to 17, and in 1924, 40 firms were operating for exchange.

During the 1920s, the Kleinwort family were known as the foreign exchange market leaders, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant F.X. traders.

The trade in London began to resemble its modern manifestation. By 1928, Forex trade was integral to the financial functioning of the city.

In 1944, the Bretton Woods Accord was signed, allowing currencies to fluctuate within a range of ±1% from the currency's par exchange rate.

U.S. President Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system.

Due to the Bretton Woods Accord and the European Joint Float's ultimate ineffectiveness, the forex markets were forced to close[clarification needed] sometime during 1972 and March 1973.

1973 was a real historical turning point in the modern foreign exchange market. This year, the Smithsonian Agreement and the European floating exchange rate mechanism collapsed, marking the free-floating exchange rate mechanism's official arrival.

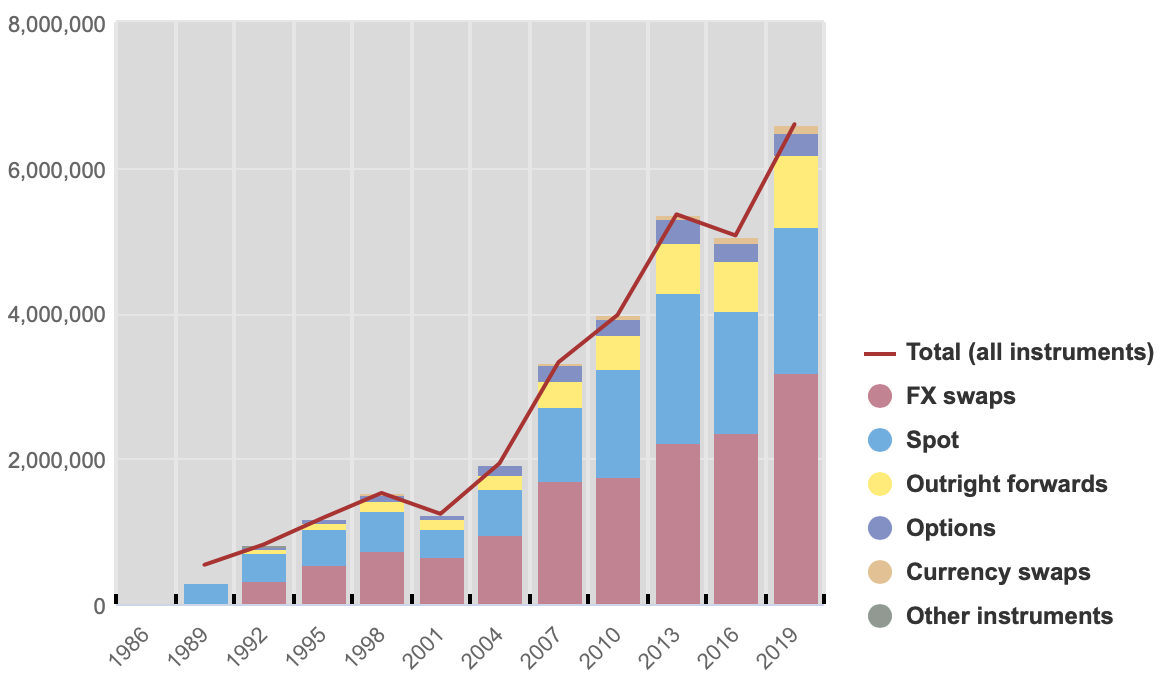

Global foreign exchange market turnover

In the 1980s, with the development of computers and related technologies, the flow of transnational capital accelerated, connecting Asian, European, and American time zone markets. The volume of foreign exchange transactions has soared from approximately US$70 billion a day in the mid-1980s to nearly US$6 trillion a day now.

English

English

TIẾNG VIỆT

TIẾNG VIỆT

简体中文

简体中文

Malay

Malay

Español

Español

Deutsch

Deutsch

Italiano

Italiano

Français

Français

Indonesia

Indonesia