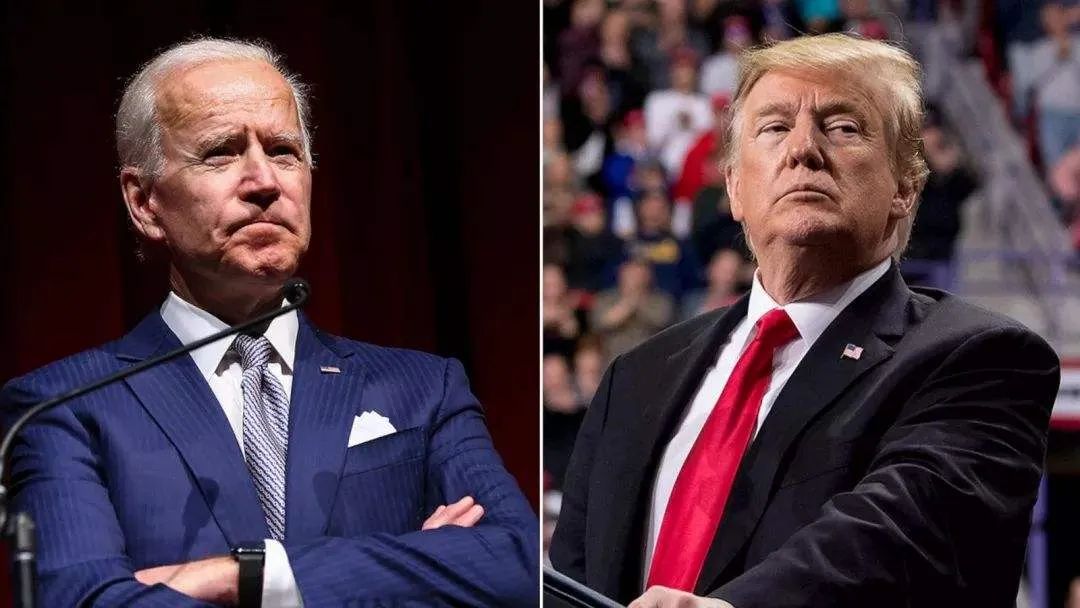

The election battle has already started. Who will benefit the gold price?

2021-07-08If Trump loses power, gold prices may rise before the election

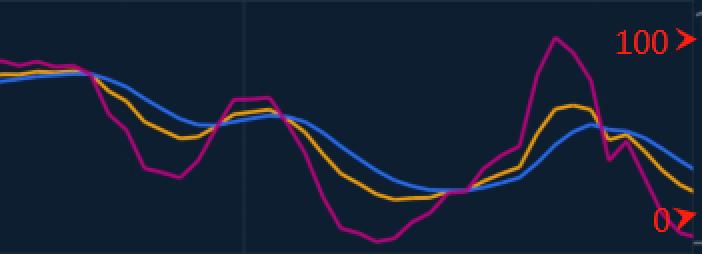

Under the epidemic, the Federal Reserve introduced an unlimited amount of easing policy, coupled with Congress’s rescue plan, which triggered a bubble in the financial market. The market risk was very high when it was realized, but because it was the election, the breakpoint was still not reached. In addition, the market generally believes that Trump’s election is beneficial to the stock market. Therefore, if Trump loses its position in the election, some investors may withdraw their funds from the stock market and turn to assets they consider safer, such as gold. High gold prices. This situation may occur before the general election, so changes in the election situation must not be ignored.

Biden's 7.3 trillion dollar policy or favorable gold market

If Biden is elected, it will undoubtedly ease the conflict at home and abroad and effectively suppress the epidemic. However, because the United States has suffered severely due to the epidemic, after Biden is elected, the chances of financial markets returning to before the epidemic are not low. The price of gold will return to the economy and fundamentals and will be affected by changes in the quantitative easing policy.

Judging from the current situation, the Fed stated earlier that unlimited easing will continue until 2023, which will allow gold prices to be supported to a certain extent. Therefore, at least before 2023, the election of Biden as president has limited impact on gold prices.

In addition, Biden proposes to launch a spending plan of US$7.3 trillion in the next 10 years. Some analysts believe that this is good for gold prices. Because of the increase in US government debt, the dollar will weaken and the price of gold will rise.

Even if Trump is re-elected, he will face a weak US economy, and the market's safe-haven demand for gold will not decrease.

Finally, if the elected president and the Congress belong to the same party, it is undoubtedly the most beneficial for governance. However, if the president and Congress split the party, the power of the president is weakened and domestic conflicts increase, which may benefit the price of gold.

If it is a real gold investment, the current gold price is under pressure and you can consider entering the market. However, if you participate in the form of leverage, you must pay attention to the current market sentiment, as the price of gold fluctuates greatly during the general election.

English

English

TIẾNG VIỆT

TIẾNG VIỆT

简体中文

简体中文

Malay

Malay

Español

Español

Deutsch

Deutsch

Italiano

Italiano

Français

Français

Indonesia

Indonesia