Choose your trading strategy (II)

2021-07-08Breakout Strategy

Breakout Strategy refers to make a position when the price has obvious directional signals. Different from the Anticipation Strategy, the direction is confirm by combination of shape, trend line, channel and other indicators. Breakout Strategy is one of the most popular trading strategy used by traders.

How to use Breakout Strategy?

Breakout strategy can be used on all chart types. The execution is the same regardless of whether it is triangle chart, bottom& top pattern or the trend line.

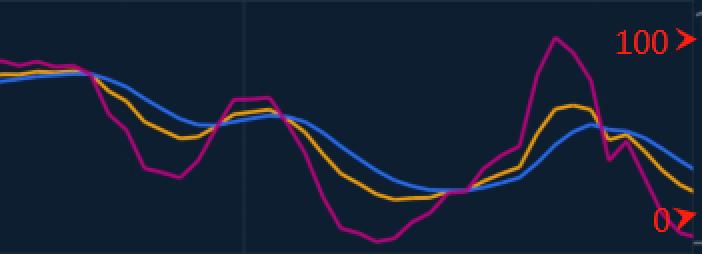

AS shown in the figure, we can Buy when the price breakouts above the upper trendline, and place a loss stop at the recent swing low.

We can Buy when the price breakouts down the trendline, and place a stop loss at the recent swing high.

Breakout strategy in Reversal :

In a Double Top, when the price drops below neckline it can be used as an entry point. Place a stop-loss order just above the high point of the second top.

In a Head and Shoulder Bottom pattern, you would trade by entering long positions when the price moves above the neckline. Also place a stop-loss order just below the low point of the right shoulder.

Breakout Strategy also uses in trendline and indicators such as Bollinger Bands, MA ,etc.

English

English

TIẾNG VIỆT

TIẾNG VIỆT

简体中文

简体中文

Malay

Malay

Español

Español

Deutsch

Deutsch

Italiano

Italiano

Français

Français

Indonesia

Indonesia